Thinking about a staycation?

July 19, 2009

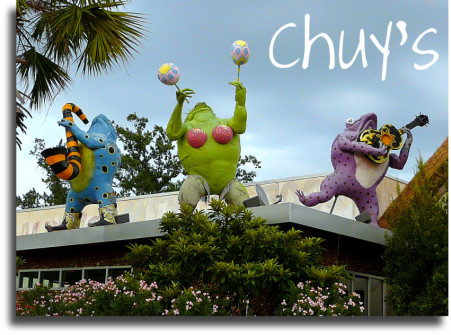

Who has the best Mexican food in Spring Texas?

July 24, 2009When shopping for a loan for your Spring Texas home you need to compare and consider more than just a lender’s interest rate. Granted the interest rate is a large factor but you should also include the mortgage lender’s service, other fees, and terms in your decision.

To help you decide which mortgage lender is the best for you, ask and compare the answers to these 10 questions:

1. Does the loan have a prepayment penalty? Find out the duration period of the penalty and the amount of the prepayment penalty. Knowing the prepayment penalty is important if you are planning on selling the home before the end of the loan duration.

1. Does the loan have a prepayment penalty? Find out the duration period of the penalty and the amount of the prepayment penalty. Knowing the prepayment penalty is important if you are planning on selling the home before the end of the loan duration.

2. What is private mortgage insurance and what can I do to avoid paying it? You may have some options available that do not include paying PMI. But you will want to review the estimated monthly payments to determine how much of a reduction the elimination of PMI nets you.

3. When can I lock in the interest rate and for how long can I lock in the rate? As soon as you provide your lender the address of the home you are purchasing he can lock your interest rate. The lender can not lock in the interest rate at the time he provides you with a GFE which is why the quoted rate may vary from the actual interest rate you receive. If you are building a home or planning on a long escrow period, you will want to ask the lender how many days in advance of the closing date he can lock the rate.

4. What if the interest rates go down, can I relock at a lower rate? If so is there a fee? Interest rates fluctuate on a daily basis and no loan officer can successfully predict which way the rates are going. But its good to know if you can hedge your bet by locking in an interest rate and still take advantage of a lower rate if one becomes available.

5. How long will it take to process my loan application? Typical loan processing times range from 30 to 45 days, but due to changes in the mortgage industry, additional procedures, and increases in the requirements for supporting documentation processing times are being lengthen by at least another week.

6. What documents do I need to provide? The lender will be able to provide you with a list of all the supporting documents he needs for proof of your income and assets.

7. What is a GFE? All lenders are required to provide borrowers / home buyers with GFEs. The GFE will identify the closing costs you should expect to pay plus other things.

8. What items on the GFE are under your control? When you are comparing the fees charged by different lenders you need to know which costs on the GFE are the lenders and which closing costs are costs for services provided by another party. Since lenders are estimating the costs charged by other parties to the transaction, the estimates for the costs will vary by lender. But remember, the lenders have NO control over the fees charged by other parties to the transaction which is why it is important to know which costs they do no have control over. Otherwise you will not be able to make a true apples to apples comparison of mortgage lenders.

9. What is the minimum down payment of the loan? What is the term of the loan? Does the interest rate remain the same over the life of the loan? You need to fully understand the terms of your home loan. Numerous home buyers were overly anxious to purchase a home that they did not spend enough time understanding all of the terms and the conditions of the loan. These are some of the same home buyers that in a couple of years were in homes they no longer could afford because the terms of the loan changed.

10. Where are your loan processors and underwriters located? Previously the physical location of the lender’s loan officer, processor, and underwriter was not extremely important. After all, they do all have access to the same systems to check on the status of your loan. But with all the recent changes in the mortgage industry, location is a worthy question to ask. If your loan officer is physically located in the same building as the processor and underwriter, he can go into their office and check with them first hand on the status of your loan. You will be able to quickly get an answer instead of having to wait on a reply from an email sent or for the game of phone tag to end.

Read also: