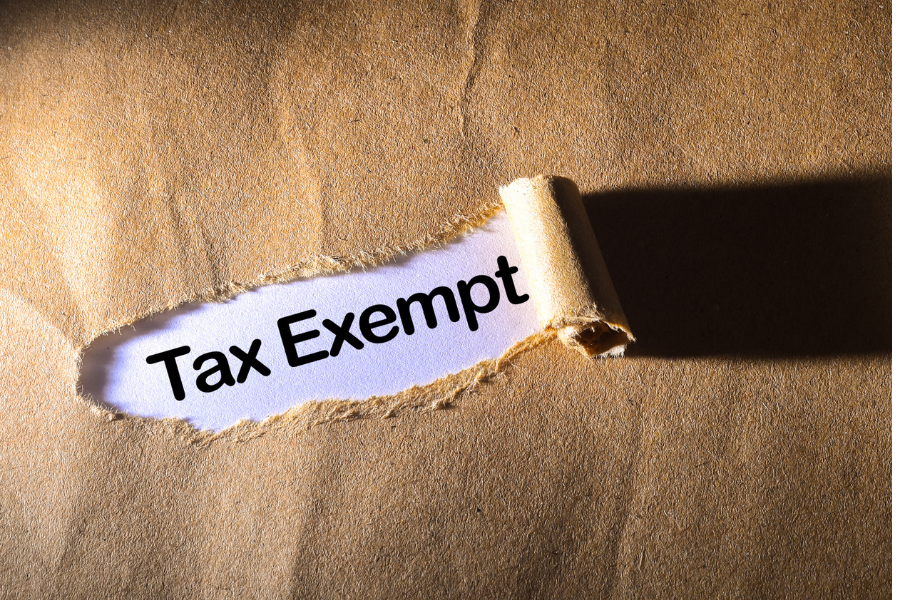

Don’t flush your credit score down the drain

February 17, 2010

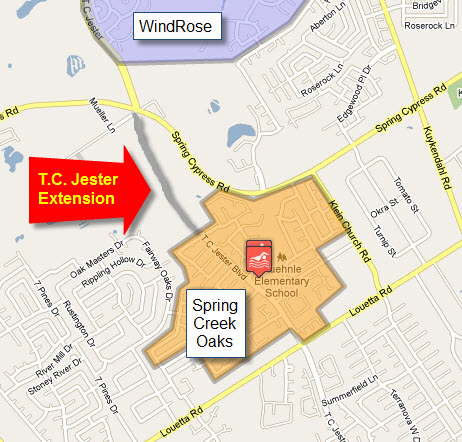

T.C. Jester connection from Louetta to Spring Cypress completed

February 22, 2010Are you going to be turning 65 soon? If so, you are probably already aware that you are eligible for Medicare. But did you know you will be eligible for a reduction in your Spring Texas real estate taxes? That’s right another reason to get excited about turning 65.

Unlike the homestead exemption that comes with restrictions on when you can apply for and receive it, the over 65 exemption has only one restriction and that is you have to wait until you reach the age of 65.

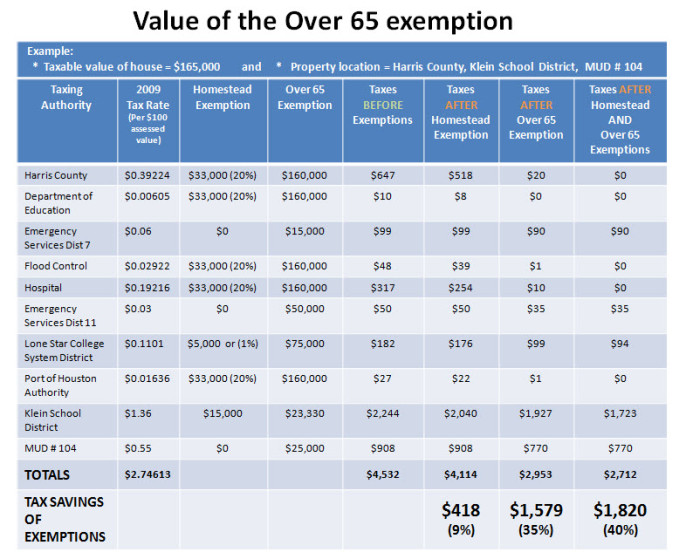

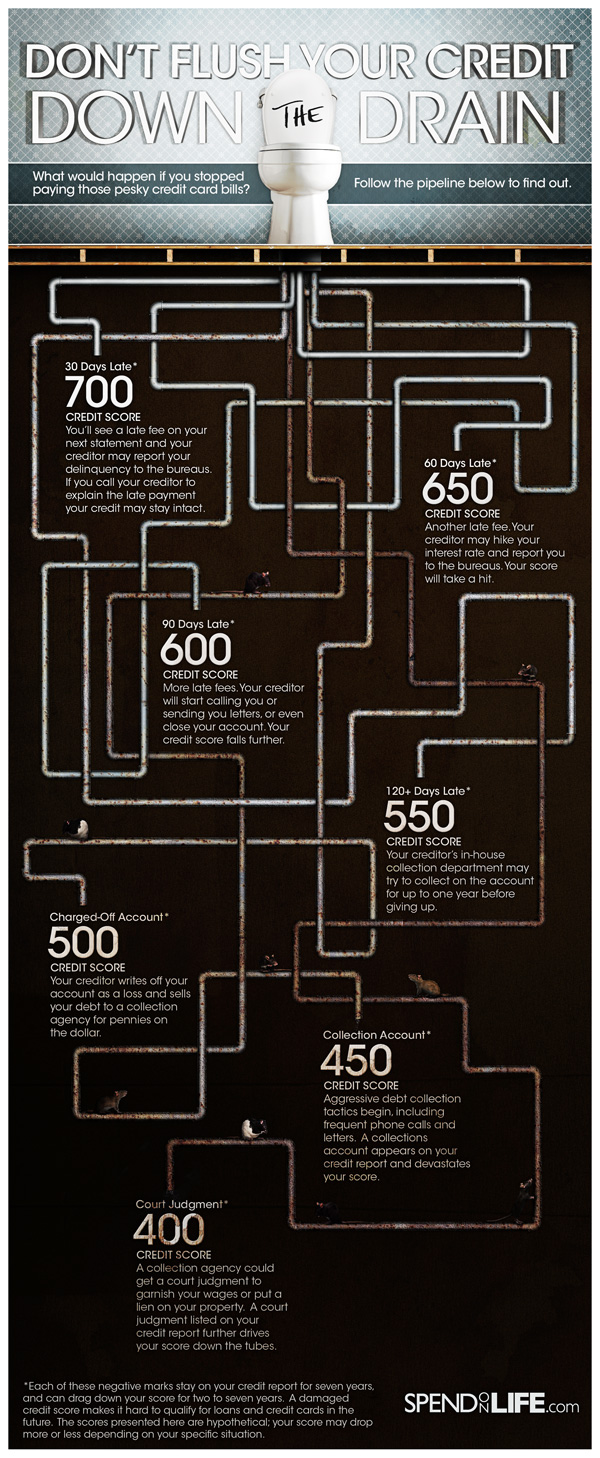

What you really want to know is what’s the value of the over 65 exemption? How much will your Spring Texas real estate taxes reduce? I dig numbers and I don’t know any better way to show you the money than through the use of a spreadsheet / chart. Click on the chart to get a larger image and a better view.

Since the over 65 exemption varies based upon county (Harris County is $160,000 and Montgomery County is $35,000), school district (Klein School District is $23,330 and Spring School District is $30,000), and MUD, I had to use some assumptions to calculate the savings in real estate taxes.

The assumptions used were:

- House is located in Harris County, Klein School District, and MUD 104

- Tax assessed value of property is $165,000

Based upon these assumptions, your annual real estate taxes for your Spring Texas home with no exemptions is $4,532.

Qualifying and receiving the homestead exemption, will reduce your taxes to $4,114. A savings of $418.

Qualifying and receiving the homestead exemption and the over 65 exemption, will reduce your taxes to $2,712. A combined savings of $1,820 or a 40% reduction in your real estate taxes. Dependent upon the county you reside in, you will either need to fill out and the over 65 exemption form for Harris County or the over 65 exemption form for Montgomery County.

Plus the over 65 exemption, freezes the school tax portion of your real estate taxes. The school tax portion will not increase with rate increases in the school tax nor with increases in the value of your Spring Texas home. But it will increase if you make substantial improvements to your home through the addition of a pool or another room.