What the heck is a QR code?

January 19, 2011

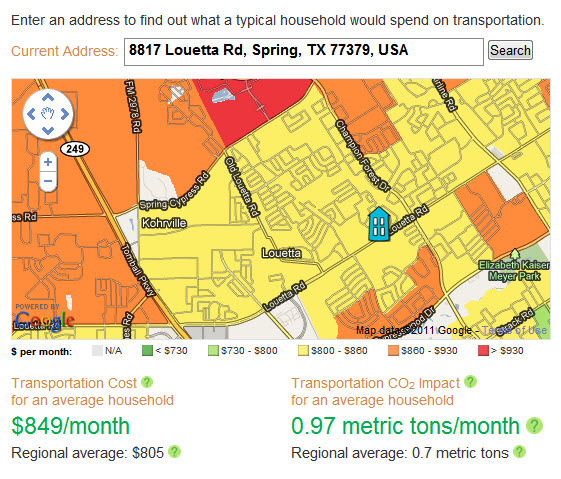

There’s more to consider than just your commute to work

January 24, 2011 18 months ago you bought a new construction home in Spring Texas. You moved in, bought new furniture, painted a few rooms, and made it your home. Life was GOOD!

18 months ago you bought a new construction home in Spring Texas. You moved in, bought new furniture, painted a few rooms, and made it your home. Life was GOOD!

Until the day you received a notice from your lender, demanding $9,000 due to a shortage in your escrow account. Your first reaction is what the heck?!? This has to be an error because this can’t be right. You have been paying into your escrow account every month. How can it now be short $9,000?

At the time of closing, your lender established your escrow account and calculated your monthly payments based upon the tax assessed value of the property. On January 1, your house had not been built. Since Harris County Appraisal District determines the value of the property on January 1, the property was only tax assessed for the value of the lot. It was NOT tax assessed for the value of the lot and the value of the house.

December 31st rolls around and your lender pays the real estate taxes on your Spring Texas home out of the money in your escrow account. The taxes get paid. There is no shortage in the escrow account. Life is Good!

January 1st arrives and the Harris County Appraisal District (HCAD) assesses your property for the value of the lot AND the value of the house that now sits on the lot. HCAD does not inform your lender of the new tax assessed value of your property. Your lender does not adjust your monthly payments to escrow the increase in the tax assessed value of the property. Your monthly escrow payments remain calculated at only the value of the lot.

December 31st rolls around and your lender pays the real estate taxes on your Spring Texas home out of your escrow account. This time there is NOT enough money in the escrow account to pay the real estate taxes. Your lender sends you a notice demanding you immediately pay $9,000 to cover the shortage in your escrow account. Life is NOT Good!

When you close on a new construction home in Spring Texas ask the closer the tax assessed value of the property. If the property is only tax assessed at its lot value, then monthly set aside the real estate taxes for the value of the house. If you don’t, you will get an unpleasant surprise from your lender demanding you cover the shortage in your escrow account.

Read also: