Who has the best cheese fries in Spring Texas?

January 24, 2010

Smile, you’re on red light camera

January 28, 2010Loan officers, escrow officers, and Realtors® have all been scrambling over the last 60 days to either implement or simply to understand the revamped GFE and HUD-1 settlement statement that went into effect on Jan. 1, 2010.

The purpose of the new GFE (Good Faith Estimate ) is to help make shopping for a home mortgage easier for borrowers and the purpose of the new HUD-1 (Housing Urban Development -1 settlement statement) is to make comparing the GFE to the settlement statement easier. Both really good things for borrowers and changes that were long overdue.

The new GFE is a huge improvement over its predecessor and it should make it easier for borrowers to compare the loans terms amongst various lenders.

What was wrong with the OLD GFE that the NEW GFE fixes?

1. Standardization. Previously the GFEs provided by lenders did not look the same making it difficult … if not impossible to compare GFEs from different lenders.

2. Identification of fee originator. The old GFE did not identify whether a fee was charged by the lender, the title company, or the insurance company. If lender 1 estimated lower third party charges than lender 2, you were lead to believe that you would be spending less money by using lender 1. As a borrower you were left trying to make decisions based upon misleading information.

3. Lender charges reduced to two items. Its a whole lot easier to identify the bottom line or the bottom number when all of the lender’s charges are rolled up into just two line items. Previously you had a list of 8 to 10 separated out charges which would be okay if Lender A called his charges the same as Lender B but that was not case. Lender A would call it a processing charge and Lender B would call it an administrative charge.

The amount of the lenders charges on the GFE have to match exactly to the HUD-1 / closing statement. They can not change.

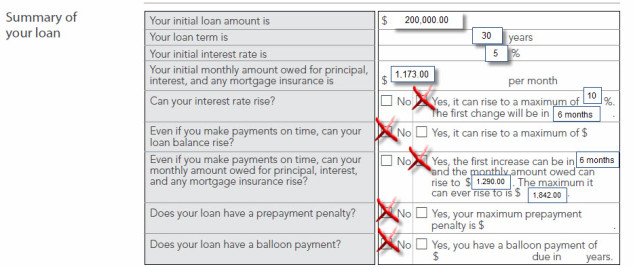

4. Terms of loan are front and center. The old GFE did not identify if the interest rate on a borrowers loan could increase, if the loan has a balloon payment, or if there was a prepayment payment. These are all identified now on page 1 of the GFE in the Summary of your loan section. Below is an example.

The GFE does freeze the origination charge but it does not commit the lender to the rates and points shown on the GFE. The rates and points on the GFE are not final until they are locked by the lender. If the loan has been locked when the borrower receives the GFE, the GFE will show the lock period of usually 30 to 60 days.

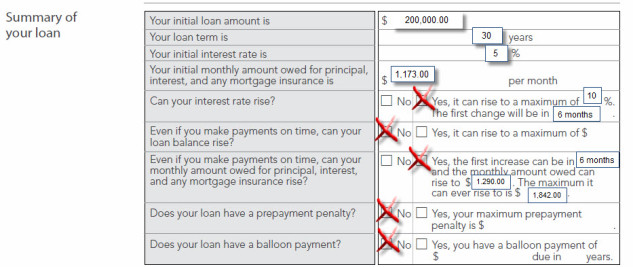

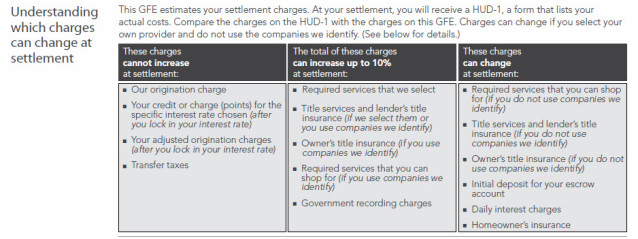

5. Limits placed on fees changes. The new GFE also changes the way in which third-party charges are disclosed. HUD has imposed strict limits on how much the GFE figure can change. Some charges like the origination fee can not change at all. Others like the title search fee can change but by no more than 10 percent. If the numbers on the HUD1 / closing statement are outside their allowable tolerance levels, the parties can still close but the lender has to fix the discrepancy within 30 days.

Below are the three pools that every fee on the GFE has to be placed into.

If certain charges increase between the GFE and the HUD1 settlement statement then a new GFE must be provided and the buyers must wait 3 days before closing. By restricting the quantity of fees that can change at closing and limiting the potential increase of fees, there will fewer unpleasant surprises at the closing table for home buyers.

6. ONLY identifies the borrowers monthly principal + interest and mortgage insurance premium. This is a MISTAKE. The old GFE provided an estimate to the borrower of his TOTAL monthly payment including homeowners insurance and real estate taxes plus principal + interest, and mortgage insurance premium. If you are going to buy a home in Spring Texas you need to know how much your monthly payment is going to be not just a portion of your monthly payment. This is the only beef I have with the new GFE.

Click on the links to view the new GFE and the new HUD-1. One more thing …. if you want to find out more about the GFE and the HUD, you can read the Shopping for your home loan booklet published by the Department of Housing and Urban Development.